Real Estate Forgeries: Cons to Look for and How to Protect Yourself

Bobby Broils of Kansas City, MO, couldn’t believe his eyes when he saw a quit claim deed his mother had signed relinquishing the home he’d grown up in – especially since she seems to have signed it four years after her death in 2008.

When his mother moved out shortly before her death, the bank had approached him and his siblings about the home. His mother had refinanced, and no one in the family could afford the balance on the loan. They let the house go vacant and assumed the bank would simply take it over.

Then in 2012, Bobby heard the home would be sold by the city for back taxes. He and his brothers thought about making a bid but then never acted on it. Soon after that, he heard from neighbors that someone had moved in, so they assumed the property had been sold.

Until an investigative reporter called and showed him the forged deed. He had no idea someone had stolen his mother’s house.

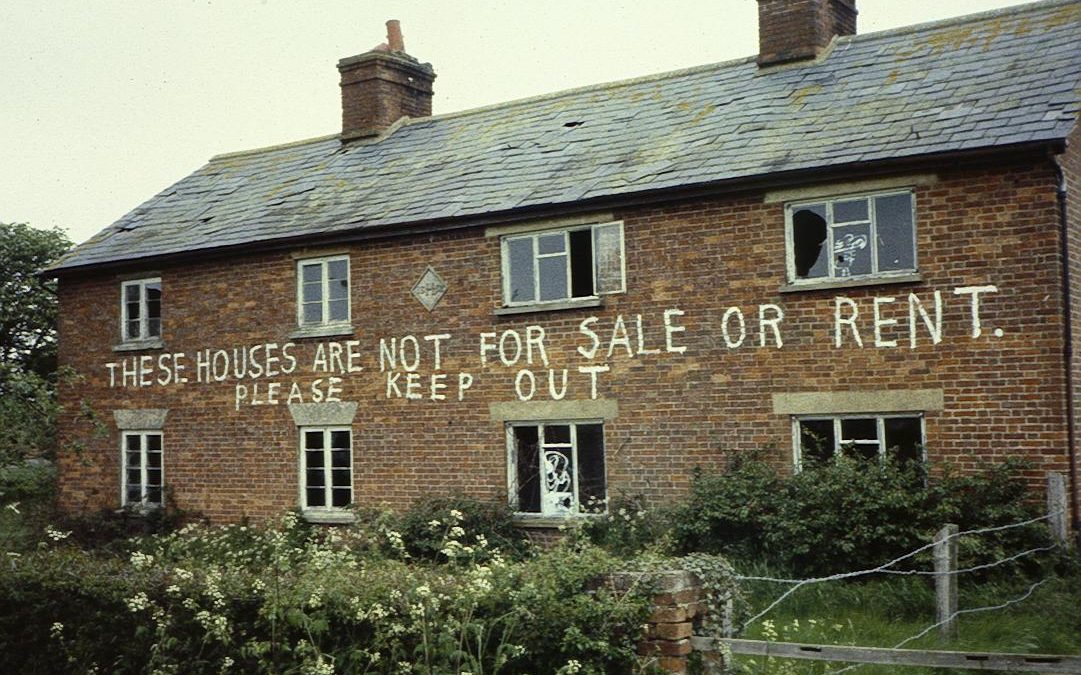

Forgeries are more common than people think in real estate transactions. Sometimes, forgeries are created by con artists looking to make some fast cash, like the woman in the D.C. area who was renting out empty houses to people and forging documents to make it look like she owned these homes.

Other times, forgeries are acts of desperation. In contentious divorces or situations with missing or estranged heirs, people may be motivated to forge documents to move a real estate deal forward if the person in question can’t be found or won’t cooperate.

Even big banks and mortgage companies are getting in on the action. Slate.com reported that banks got caught forging legal documents on a large-scale basis. Banks were selling each other mortgage-backed securities and foreclosing on homes so fast, sometimes they forgot to make sure they actually had the proper documentation of ownership before foreclosing and selling people’s houses. When the mistakes came to light, they tried to forge documents to cover their mistakes and salvage the foreclosures.

If you bought one of those homes through foreclosure and the court found for the original home owners, you may or may not still technically own your home.

It doesn’t matter how long ago the forgery took place. As recently as May 2015, the Court of Appeals in New York State issued a decision affirming there is no statute of limitations for a claim based on a forged deed, since the forged deed is automatically null and void.

Because forgeries are more common than people think, making sure a thorough title search is conducted before you close on any real estate deal is absolutely essential. After all, you don’t want to buy someone else’s title problems. And title insurance can protect you from any undiscovered forgeries in your own property’s past that could haunt you when you go to sell your property.

Make sure you know whom you’re dealing with when entering any real property transaction. Ask questions. Ask to look at original documents. If something seems fishy, call it out or ask a trusted advisor from your own camp to take a look at the deal.

And remember, if a deal sounds too good to be true – it probably is.

It’s buyer beware out there. Protect yourself by choosing reputable professionals when you go to close on your deal, and invest in title insurance to protect your property for as long as you own it.

Related Posts

Leave a Reply Cancel reply

Categories

- Client story (5)

- Commercial (8)

- Residential (13)

- Richmond (6)

- Safe Harbor Title Company (1)

- Security (4)

- Uncategorized (18)

- Yorktown (1)